Xero Accounting System brings family business up to date

Antiquated accounts systems cost money

The 45 year old small family business had not developed their financial systems in line with their shop floor operations.

Set up by Jeff Baron in 1975, Diamond Anchor Ltd had been with the same firm of accountants since its inception. A lady did all their financial administration by hand!

Some aspects of Sage were being used to help manage the Debtor and Creditor Ledges, all sales invoices were typed manually and sent out by post. This archaic practice cost valuable time for the business in generating cash flow, and was very expensive.

The introduction of HM Revenues and Customs legislation ‘Making Tax Digital’ requires that statutory returns, such as VAT, to be submitted via the company’s digital portal. Therefore Diamond needed to act fast to bring their accounting systems up to date and in line with the new regulations. The deadline for compliance was April 2019.

How did we fix it?

We introduced the company to Hammond and our approach to Making Tax Digital using the Xero accounting system and Receipt Bank.

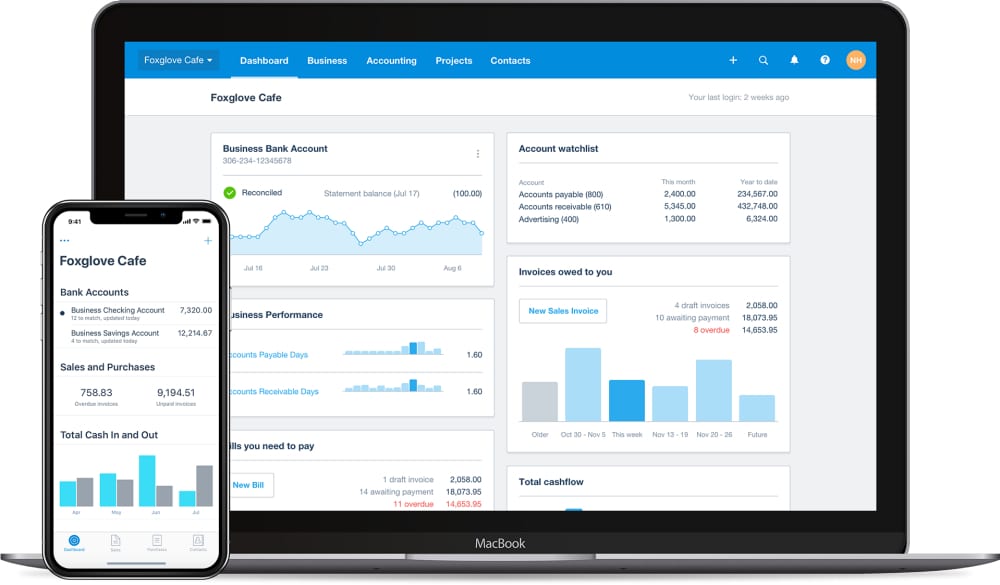

Xero is a digital book keeping system. Receipt Bank works in tandem with Xero and is a digital system for dealing with payments.

With all financial administration being done via the Xero digital platform, now all sales invoices could be produced in house and added directly to the bookkeeping sales ledger, debtor file and profit and loss account. When clients pay the relevant sales invoices into the company’s bank account, the payments are easily reconciled on the Xero system.

Screenshot of the Xero Accounting System

Screenshot of the Xero Accounting System

Receipt Bank is then used to take pictures of all other purchase invoices and it automatically moves the supplier payment requests/invoices/expenditure receipts into Xero for them to be matched in the financial records when the payments are made.

The introduction of these changes to the accounting systems mean that back office management now matches the efficiency of the shop floor. The Xero Accounting System allows the business up to date book keeping and speeds up cash flow.